How Blockchain and AI Are Shaping Know Your Customer

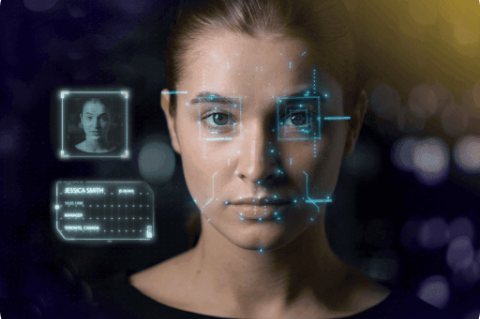

Picture this: you want to open a bank account, or use a crypto exchange, or start trading stocks. You’re asked to verify your identity, submit documents, wait days. Frustrating, right? That old way of kyc verification is changing fast. Thanks to advances in artificial intelligence and blockchain (plus a dose of big data), identity checks are getting safer, faster, and more respectful of privacy.

In this article we’ll explore how blockchain and AI are working together to reshape KYC, share real data and case studies, and see what it might mean for you or your business.